MACD - Wikipedia

MACD, short for moving average convergence/divergence, is a trading indicator used in technical analysis of securities prices, created by Gerald Appel in the late 1970s. [1] . It is designed to reveal changes in the strength, direction, momentum, and duration of a trend in a stock's price.

MACD - Schwab Brokerage

MACD (Moving Average Convergence/Divergence) is an oscillator study that is widely used for assessment of trending characteristics of a security. Calculated as the difference between two price averages, this indicator also provides a signal line, an average of that difference.

How to Calculate MACD in Excel - Invest Excel

Learn how to calculate and plot MACD in Excel, and make better trading decisions. Traders used MACD to forecast price movements and maximize profits.

What Is MACD? - Investopedia

Sep 16, 2024 · Moving average convergence/divergence (MACD) is a trend-following momentum indicator that shows the relationship between two exponential moving averages (EMAs) of a security’s price.

How to Create a MACD Chart – HowtoExcel.net

Jan 18, 2022 · The MACD line and chart is a popular tool for technical analysts who buy and sell stocks. And in this post, I’ll show you how you can create it from start to finish. In my example, I’ve downloaded Apple’s stock price history for the past year …

MACD (Moving Average Convergence/Divergence) Oscillator

Developed by Gerald Appel in the late seventies, the Moving Average Convergence/Divergence oscillator (MACD), due to its simplicity and general effectiveness, is one of the most popular momentum indicators.

When To Use And How To Read The MACD Indicator

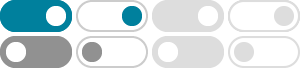

Mar 27, 2022 · There are three main components of the MACD shown in the picture below: MACD: The 12-period exponential moving average (EMA) minus the 26-period EMA. MACD Signal Line: A 9-period EMA of the MACD. MACD Histogram: The MACD minus the MACD Signal Line. The MACD indicator is a versatile tool.

MACD with Python. The world of technical analysis in ... - Medium

Jan 6, 2024 · The MACD histogram, the visual representation of the difference between the MACD line and the signal line, provides insights into the strength and direction of the trend.

MACD (Moving Average Convergence/Divergence) - TradingView

The MACD histogram takes that difference and plots it into an easily readable histogram. The difference between the two lines oscillates around a Zero Line. A general interpretation of MACD is that when MACD is positive and the histogram value is …

What Is MACD? - Moving Average Convergence/Divergence

The Moving Average Convergence/Divergence indicator is a momentum oscillator primarily used to trade trends. Learn how you can use the MACD to make informed investing decisions.